What is new however seems to be two things:

- The types of services going into these contracts are growing. They are helped largely by rapid technology which allows suppliers to gather more data about how and when the assets are being used.

For example, before it was just ink, now it is everything to device connectivity, user key cards, and in-life fleet optimisation services. Like the printer, many assets are almost becoming the loss leader for a supplier to be able to sign up customers to services. And as we’ve seen historically in some markets, many suppliers have been able to earn a higher margin on services than on equipment mark-up. This trend to selling more services is hardly surprising.

- Customers are starting to demand outcome-based contracts. Put simply: “supply me what I need to deliver my business outcome. Don’t just give me the asset."

A good example at the consumer level is Amazon Prime – for one monthly payment we get a lot of services: free package delivery, TV and music streaming. We can even get free audio-books and an echo-dot thrown in if we sign-up at the right time. So we’re not buying DVDs and CDs anymore, we’re getting our outcome from services. Now I know this is difficult to relate to hard assets like diggers – you can’t just stream a digger. But how about if the supply you offered the customer was defined as an outcome. Instead of “we will supply you with a digger at £x per month” what if it was “we will supply you with what you need to complete your jobs this year”? Suddenly this transforms the proposition from an asset with no direct connection to the job, to a service contract where you will provide assets which are fuelled, serviced, insured (and possibly manned), and right-sized for the outcome the customer wants to achieve. The supply has now been servitized and linked to the customer’s desired outcome. If it turns out that the customer doesn’t actually get as many jobs that year to cover the cost of the asset deployed, then DLL is open to taking on that risk of under-usage.

Servitization is gaining traction in B-to-B markets

So what we’re seeing at the consumer level, we’re starting to see at the business level. And there can be a multitude of reasons for this – from simply wanting the convenience of buying a one-stop-shop solution, to the business customer wanting to de-risk their operation by paying for outcomes only. It may be as simple as the fact that every business leader is a consumer at home, and the value logic has therefore already been experienced and accepted. Good concepts at the consumer level almost always bubble up into the business world. And this is across all industries, because at the end of the day every type of asset can be coupled with some sort of service to deliver true value.

The interesting thing will be to see this evolve as more and more suppliers start to bring servitized solutions to market. It is likely a lot of these solutions will be incredibly clever and things that we don’t even think we need today. The analogy I use is that everyone was very happy with the Nokia3210 until the first iPhone came along, and now we can’t do without the iPhone. I suspect the same will be said of servitized solutions as they come to market.

Fundamental shift across businesses

Another feature of servitized offerings is that they allow suppliers a medium by which to provide their customers with experiences. No longer a supply of asset on day one, but a bespoke service solution that is supplied and adjusted to fit to the customer’s needs over time. Done well, it can move a supplier into the enviable position of being a true business partner to their customers instead of simply one of selling units. It is a move towards focusing more on enabling the success of your customers rather than simply providing them with a product and leaving them to figure out how to get optimal value from it.

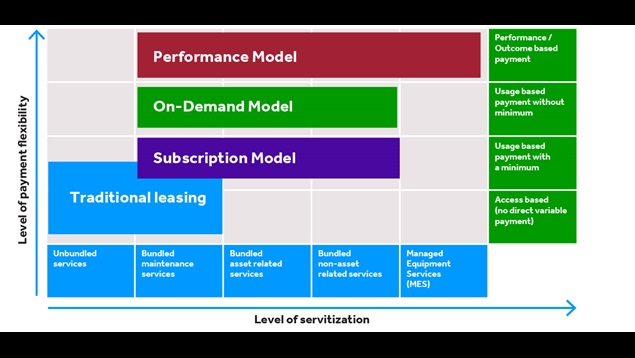

Creating flexible funding solutions for servitized offerings

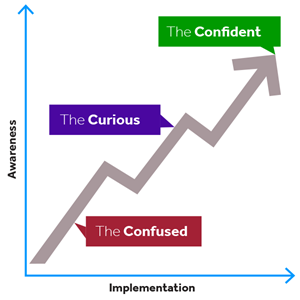

It is not to say servitization is for everyone, but logic would dictate the more you help a customer to achieve their outcomes the more valuable you will be to their operation. At DLL we believe the market is well along the curve of an evolutionary shift in asset procurement, and we are busy creating funding solutions that align to this.

As the market moves to ask for more services and outcome based contracts, traditional funding models need to change. And that’s what where we come in.