Section 179 Quick Guide

Your business may qualify for significant tax savings.

Understanding the basics of Section 179

Section 179 is a tax deduction, which allows businesses to subtract the cost of certain types of assets from their balance sheet. Qualified purchased assets or leased assets can be written off as an expense during the purchase year. In order to meet the tax deduction, the qualified assets must be in use by December 31 of the tax year. Businesses can elect the tax deduction when filing their annual tax return.

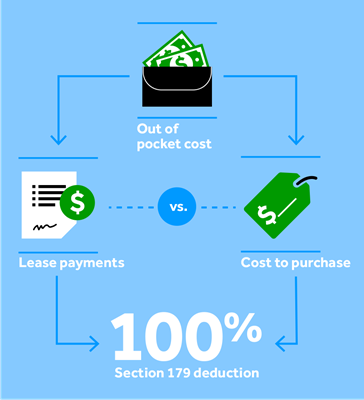

The visual represents out of pocket costs for newly acquired leased or purchased equipment eligible for Section 179. While both leased and purchased equipment may qualify for the deduction, the difference is out of pocket expense. With leased equipment, you can pay less upfront, pay monthly lease payments, and still receive 100% deduction under Section 179.

Write it off now and pay it off over time

This means you may be able to write off most or all the cost of newly acquired capital equipment in 2023. New capital equipment which is purchased and/or financed and placed into service between January 1 and December 31, 2023 may qualify for these deductions. This may include equipment that you acquire via capital lease ($1 purchase option).

Additional information to consider:

- If IRS Section 179 allowance of up to $1,160,000 is used, capital equipment purchases over that allowance may be eligible for 80% Bonus Depreciation of the remaining basis after taking Section 179.

- OR, 80% Bonus Depreciation may be used instead of Section 179 for capital investment.*

- The remaining basis of 20% is then depreciated over the remaining useful life of the asset using MACRS.

Which assets qualify for Section 179?

Qualifying Assets

- Automobiles

- Computers and software

- Office equipment

- Machinery

- Tractors

- Trucks

Ineligible Assets

- Billboards

- Buildings

- Fences

- Land or Landscaping

- Non-mobile trailers

Discover the benefits of Section 179 and bonus depreciation

| Potential Tax Savings | 2023 Tax Year |

| Purchase price | $1,500,000 |

| Total tax deduction using Section 179 | $1,160,000 |

| Additional tax deduction for 80% Bonus Depreciation (Basis after 179 x 80%) | $272,000 |

| 20% MACRS depreciation on remaining basis (Basis after 179 & bonus / 5 years) | $13,600 |

| Basis after depreciation | $54,400 |

| Potential tax savings in the 21% tax bracket | $303,576 |

| Net equipment cost after tax savings | $1,196,424 |

Take advantage of Section 179 for qualifying assets

*Disclaimer: DLL does not provide legal, tax or accounting advice. The customer must obtain and rely on such advice from its own accountants, auditors, attorneys, or other professional advisors. These materials are for informational purposes only. Nothing herein constitutes tax advice and customers should consult with their tax advisors prior to electing specific rates or options.